INICIO › FOROS › NOVEDADES › Actualidad del motor › Noticias Alianza Renault–Nissan–Mitsubishi

Etiquetado: Alianza renault, alianza renault nissan, Alpine, Alpine A480 (2021), Automobiles Alpine Renault, Automobiles Alpine Renault: Asociación Renault-Caterham, Avis, Avis alquilará coches eléctricos Renault, Avtovaz da ganancia por primera vez en años, Comienza a fabricarse el nuevo Nissan Juke del que hay 22.500 pedidos, Dacia, Dacia Sandero, Datsun, El Renault Koleos se despide de Reino Unido, El terremoto de Japón desbarata la producción del Nissan Murano CrossCabriolet, Elpais, Entrevista al Director Programa Vehículo Eléctrico de Renault, Francia, Francia confirma que hay un caso 'grave' de espionaje a Renault, Infiniti, Infiniti presentará dos nuevos modelos de la familia M en Pebble Beach, la estrategia ecológica de Nissan, La producción del Megane obliga a trabajar los domingos, Los Renault Clio y Twingo contarán con el dCi 90 FAP, Mahindra, Mañana (30-11-2011) presenta un nuevo modelo, Misterioso teaser de Infiniti y registro de las siglas JX, Mitsubishi, Mitsubishi Alliance, Mitsubishi confirma que el Evo seguirá vivo pero con cambios importantes, Nissan, Nissan adjudica la nueva furgoneta a Barcelona, Nissan aumenta la producción de su planta de Barcelona, Nissan barcelona, Nissan crea la marca Venucia para China, Nissan Leaf: 3.754 solicitudes de reserva en Japón en sólo 3 semanas, Nissan venderá en Asia y EE UU el Twizy que se fabricará en Valladolid, Nissan Zona franca, Noticias, Noticias Alianza Renault-Nissan (C), Noticias Alianza Renault–Nissan–Mitsubishi, Noticias MITSUBISHI, Noticias Renault–Nissan–Mitsubishi Alliance, Planta zona franca, Presentación europea de Fluence ZE y Kango ZE en Sevilla en octubre, Pure Drive, Renace Datsun, Renault, Renault 2016 - Drive The Change, Renault alcanza el hito de 1 millón de automóviles vendidos en Brasil, Renault Clio, Renault inicia la fabricación del Twizy en la factoría de Montaje de Valladolid, Renault rompe su alianza con Mahindra, Renault Samsung Motors sustituye el manual de instrucciones por un Galaxy Tab, Renault Twizy: éxito de ventas, Road show de vehículos electricos de Renault en Madrid, samsung motors, Se fabricará en Córdoba un nuevo Renault Clio para el Mercosur, Ventas, Venucia, Ya hay 3500 pedidos de particulares para el Twizy

- Este debate tiene 1,095 respuestas, 78 mensajes y ha sido actualizado por última vez el hace 3 semanas, 1 día por

Reppu.

Reppu.

-

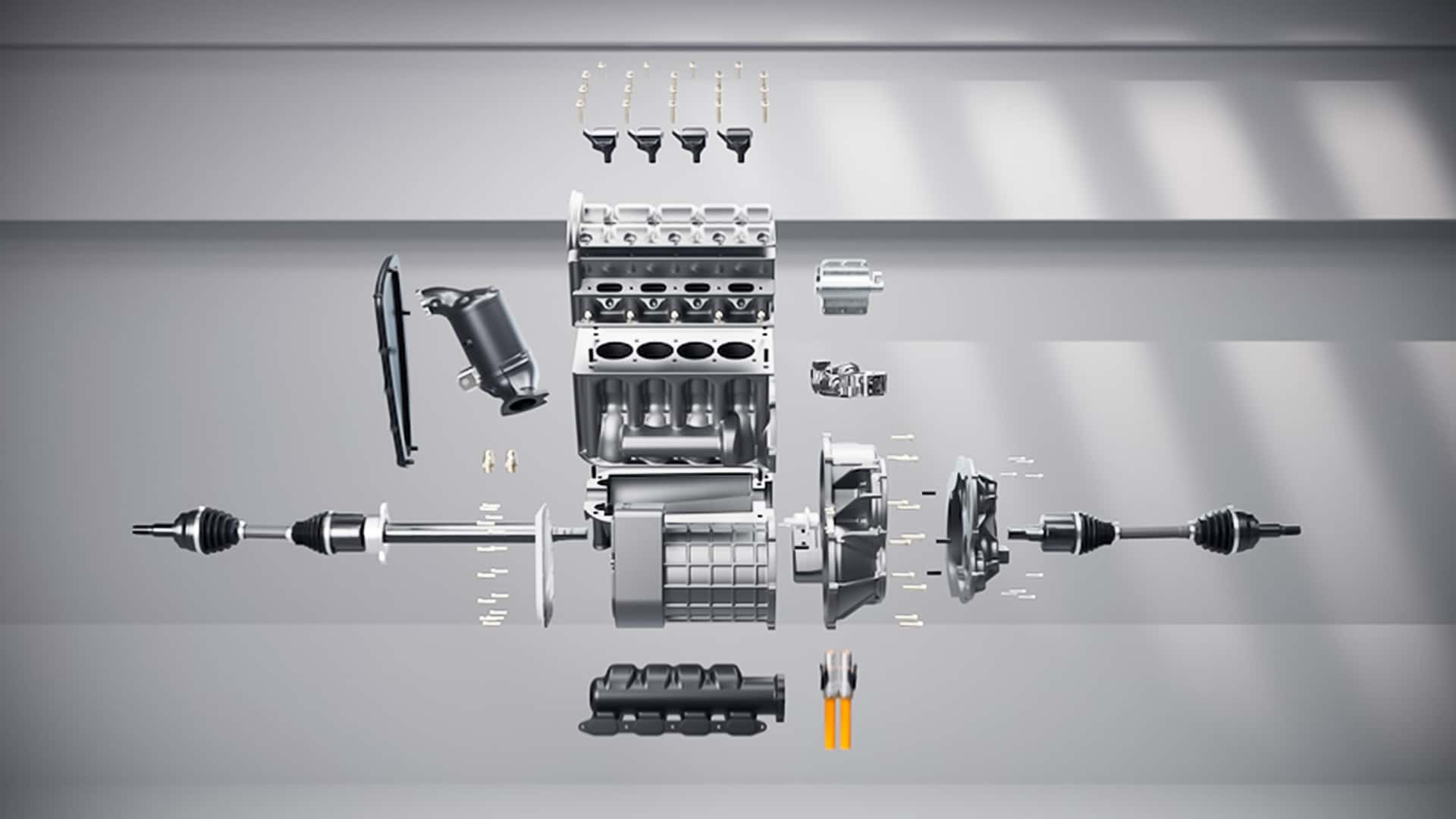

Horse presenta el concepto de motor Future Hybrid.

Horse Powertrain ha desarrollado por primera vez un sistema de propulsión combinado formado por una unidad de motor y transmisión que puede sustituir al motor eléctrico delantero de un BEV o introducirse en una plataforma de motor de combustión tradicional. Ambas opciones son posibles con modificaciones mínimas.

El sistema de propulsión modular se adapta a las plataformas de vehículos eléctricos a batería (BEV) existentes y funciona como un extensor de autonomía para la batería existente, mientras que la transmisión y los ejes de transmisión permiten el funcionamiento con tracción en las cuatro ruedas tanto en modo EV como en modo paralelo.

El Future Hybrid Concept puede funcionar con una variedad de tipos de combustible. Éstos incluyen gasolina, combustibles flexibles de etanol, metanol puro y combustibles sintéticos modernos. Por lo tanto, también es interesante para mercados como el de Sudamérica.

Fuente: Horse

Ese sistema bien podría vale para añadir la hibridación a los eléctricos de Renault. Aunque no han mostrado ni cilindrada, especificaciones…

Más problemas para Nissan: nuevos despidos y graves problemas económicos

- Se hace un nuevo recorte de personal, esta vez 10.000 empleados (más los 9000 anteriores), un 15% de su plantilla

- parece que se van a cerrar fábricas, o vender, como ha pasado en Tailandia con Renault

- quieren hacer que Nissan sea una empresa algo más pequeña, porque está sobredimensionada

- tienen que ser más rápidos y ágiles

Parece que van a apoyarse en las marcas de la asociación para avanzar. Ya se sabía en el caso de Renault para Europa. Pero también parece que sigue hablando con Honda para hacer modelos conjuntos en EE.UU. Ya no se habla de asociación o fusión (más bien era Honda ser la que manda y Nissan la 2ª a bordo), sino colaboraciones.

https://www.motor.es/noticias/mercedes-ventas-perdidas-europa-2025108118.html

https://www.autonocion.com/crisis-en-nissan-20-000-despidos-y-un-futuro-incierto-segun-su-ex-ceo/

Todos estos son problemas que ya llevaban tiempo agrabandose. Y no ayuda que Ghosn esté también por ahí soltanto puyas. Pero tiene razón, y siempre se ha dicho, Nissan es muy soberbia y siempre ha actuado muy lentamente, con lo que esto es de nuevo la repetición de lo que pasó hace años. Pero ahora peor, porque las pérdidas son enormes

Nota de prensa, en inglés

Nissan sets the stage for change with the bold Re:Nissan plan

- Aims for positive operating profitability and free cash flow in the automotive business by FY 2026

- Achieve total cost savings of 500 billion yen vs FY24 actuals in fixed and variable costs

- Reduce workforce by 20,000 and plants from 17 to 10 by FY 2027

YOKOHAMA, Japan – Nissan Motor Co., Ltd. announced today Re:Nissan, a recovery plan that implements decisive and bold actions to enhance performance and create a leaner, more resilient business that adapts quickly to market changes. With a fresh focus under new management, Nissan is reassessing its targets and has conducted a comprehensive review of key initiatives, introducing further measures to ensure a strong recovery.

Nissan president and CEO Ivan Espinosa said: «In the face of challenging FY24 performance and rising variable costs, compounded by an uncertain environment, we must prioritize self-improvement with greater urgency and speed, aiming for profitability that relies less on volume. As new management, we are taking a prudent approach to reassess our targets and actively seek every possible opportunity to implement and ensure a robust recovery. Re:Nissan is an action-based recovery plan clearly outlines what we need to do now. All employees are committed to working together as a team to implement this plan, with the goal of returning to profitability by fiscal year 2026.»

With Re:Nissan, the company targets a total cost savings of 500 billion yen versus fiscal year 24 actuals in fixed and variable cost savings. These savings will establish a framework to secure operating profitability and free cash flow in the automotive business by fiscal year 2026.

Variable cost reduction: In the new plan, Nissan has set an aggressive cost reduction target of 250 billion yen. To achieve this, the company is accelerating engineering and cost efficiencies while implementing a rigorous governance model. A dedicated cross-functional transformation office under Chief TdC* Officer staffed by around 300 experts, has been established and is empowered to make cost decisions.

Additionally, Nissan will temporarily pause advanced and post-FY26 product activities to mobilize 3,000 people to focus on cost reduction initiatives. This reprioritization was made possible through the company’s swift implementation of a shortened development process that reduces lead time and ensures no delays in product launches.

A key aspect of this transformation involves rethinking the supply chain; Nissan will restructure its supplier panel to secure more volume for fewer suppliers, eliminating inefficiencies and challenging legacy standards.

Fixed cost reduction: While maintaining a strong focus on variable costs, Nissan will continue to seek additional opportunities to reduce fixed costs, targeting a total reduction of 250 billion yen by FY26 compared to its FY24 actuals.

Restructuring manufacturing base and refine efficiencies: Nissan will consolidate its vehicle production plants from 17 to 10 by fiscal year 2027. Additionally, the company will streamline its powertrain plants and accelerate job reformation, work shift adjustments, and capital expenditure reductions, including the cancellation of the planned Lithium Iron Phosphate battery plant in Kyushu.

Reduction of workforce: Nissan aims to reduce its workforce by a total of 20,000 employees between fiscal years 2024 and 2027, which includes the previously announced reduction of 9,000. This workforce reduction globally covers direct/ indirect roles and contractual roles in manufacturing, SG&A and R&D functions. Additionally, Nissan will implement further measures under SG&A, including expanding the scope of shared services and identifying efficiencies in marketing.

Revamp Development: Nissan is revamping its development processes by reducing engineering costs, complexity, and improving development speed. Through various initiatives such as rationalizing global R&D facilities and allocating work to competitive locations, Nissan aims to reduce the workforce’s average cost per hour by 20%.

Nissan will reduce parts complexity by 70%, while the integration and optimization of platforms will decrease the number of platforms from 13 to 7 by fiscal year 2035. The company will advance its efforts to significantly shorten the development lead time of the first vehicle to 37 months and subsequent family vehicles to 30 months. Models developed under this process include the all-new Nissan Skyline, the all-new global C SUV, and the all-new INFINITI compact SUV.

Redefined market & product strategy: Nissan redefined its market approach to better match local customer needs and tailor product strategy to align with the updated market approach. This will enable Nissan to focus on internal engineering resources in core businesses to ensure growth while securing profit.

Nissan is reshaping its product strategy to be more market-focused and more brand-oriented. Commitment to innovation will accelerate, bringing exciting advancements to valued customers. It will be centered around signature Nissan models that deliver strong nameplates which represent the heartbeat of Nissan globally, volume-driving models that will be the key drivers of the company’s performance and growth.

The market-specific approach will be positioning the U.S., Japan, China, Europe, Middle East and Mexico as key markets and adopt a customized approach to other markets. In the U.S., it includes addressing rapidly expanding segments such as hybrids and revitalizing the INFINITI brand through synergies with the Nissan brand. In Japan, expansion of model coverage will contribute to reinforcing the brand in its home market. The approach in China will focus on enhancing domestic performance with NEVs. Also exports from China will support catering to diverse and global needs. In Europe, the focus will be on B and C segment SUVs. Nissan will leverage partnerships with the Renault Group and partners from China to further diversify offerings. In the Middle East, the company will focus on large SUVs while exploring products from China to enhance competitive offerings. Mexico will continue to serve as an important export hub, contributing significantly to profit and growth.

Reinforce Partnerships: Nissan will collaborate with partners to deliver models that complement its portfolio and meet unique market needs. Several projects with its alliance partners, Renault and Mitsubishi Motors (MMC) are underway, including the recently announced initiative for an all-new battery electric vehicle (BEV) based on the next-generation LEAF for MMC’s North American market. Nissan and Honda will continue their collaboration in vehicle intelligence and electrification.

Re:Nissan clarifies the necessary steps to recover performance and establishes clear timelines following a comprehensive review of the company’s current situation. Although the targets are ambitious, the strategies and actions are well-defined. Nissan remains committed to the steady implementation of this plan to recover performance.

Nissan reports financial results for fiscal year 2024

- Full year operating profit of 69.8 billion yen

- Negative free cash flow of 242.8 billion yen and operating loss of 215.9 billion yen in the automotive business for the full year

- FY25 forecast to be determined due to uncertainty from potential impact of the tariff.

YOKOHAMA, Japan – Nissan Motor Co., Ltd. today announced financial results for the full year and the fourth quarter of fiscal year 2024, ending March 31, 2025.

Full year financial results

In FY2024, global sales remained at 3.346 million units impacted by intensified sales competition. Nissan’s consolidated net revenue was 12.6 trillion yen, resulting in an operating profit of 69.8 billion yen with an operating margin of 0.6%.

Net loss1 was 670.9 billion yen. While free cash flow and operating profit in the automotive business were both in negative, automotive net cash was 1.498 trillion yen.

TSE report basis – China JV equity basis2

Yen in billions FY 2023 FY 2024 Variance vs FY23 Revenue 12,685.7 12,633.2 -52.5 Operating profit 568.7 69.8 -498.9 Operating margin % 4.5% 0.6% -3.9 pt Ordinary profit 702.2 210.2 -492.0 Net income1 426.6 -670.9 -1,097.5 Based on average foreign exchange rates of 153 JPY /USD and 164 JPY /EUR for FY2024

Fourth quarter financial highlights

In the fourth quarter of fiscal year 2024, consolidated net revenue was 3.490 trillion yen, consolidated operating profit was 5.8 billion yen, and operating profit margin was 0.2%. Net loss1 in the fourth quarter was 676 billion yen.

TSE report basis – China JV equity basis2

Yen in billions FY23 4Q FY24 4Q Variance vs FY23 Revenue 3,514.3 3,490.0 -24.3 Operating profit 90.3 5.8 -84.6 Net income1 101.3 -676.0 -777.3 Based on average foreign exchange rates of 153 JPY/USD and 161 JPY/EUR for FY24 Q4

FY2025 outlook

Nissan expects the business to continue be challenging with intense competition, forex and inflationary pressure. Yet, our efforts related U.S. Tariff policy under our mitigation strategy, we are prioritizing U.S.-built products, optimizing local capacity, reallocating tariff-exposed production, and working closely with suppliers to localize and adapt swiftly to market demands. Given the uncertainty related to tariff environment, the guidance for operating profit, net income and auto free cash flow for the fiscal year are currently to be determined.

The company has filed the following fiscal year forecasts with the Tokyo Stock Exchange. Calculated under the equity accounting method for Nissan’s joint venture in China, the forecasts for the fiscal year ending March 31, 2026, are:

FY2025 outlook

TSE report basis – China JV equity basis2 (yen in billions)Net revenue 12,500 Operating profit TBD Net income1 TBD Annual dividend per share (yen)

FY2024 0 yen FY2025 (Outlook) 0 yen 1. Net income attributable to owners of the parent

2. Since the beginning of fiscal year 2013, Nissan has reported figures calculated under the equity method accounting for its joint venture with Dong Feng in China. Although net income reporting remains unchanged under this accounting method, the equity-accounting income statements no longer include Dong-Feng-Nissan’s results in revenues and operating profit.

*The financial forecast is based on judgements and estimates that have been made using currently available information. By nature, such financial forecast is subject to uncertainty and risk. Therefore, the final results may differ from the aforementioned forecast.

Nissan empieza a echar un olor a muerto alarmante.

Y pienso que Renault está en un punto en el que pasa de todo y prefiere dejar que caigan para vender su parte y que otros se apañen con su gestión.

No quisieron la fusión impuesta por el Gobierno con Honda, también por que pensaban que su ingeniería era mejor y ahora les toca sufrir.

El orgullo acabará con ellos, y con la actitud que llevan, se lo merecen.

Estoy completamente de acuerdo, Nissan está cosechando lo que sembró, Renault los salvó de la quiebra, hizo posibles grandes éxitos para Nissan como el Qashqai, 350Z y GT-R 35, ¿y qué obtuvo? Fue tratado como un villano tanto por los japoneses como por los yanquis que parecen haber olvidado el estado de Nissan en los años 90, Nissan se va a la ruina y todo por su puro orgullo y ego, si hubieran aceptado la alianza con Renault y trabajado juntos, en lugar de intentar luchar contra el que los salvó, probablemente su situación sería mucho mejor. Como dije al principio, lo que siembras lo cosechas.

Lo que faltaba. Shock en Renault. DIMITE LUCA DE MEO COMO CEO DE RENAULT. Se hará efectiva su marcha el 15 de julio. Al parecer se va fuera del sector automovilístico, concretamente como CEO del grupo Kering.

Ahi está la noticia.

https://lat.motorsport.com/f1/news/de-meo-renuncia-renault-ceo/10733202/

En el fondo es una noticia muy chunga, deja a la alianza a la mitad de lo que quería hacer.

Renault estaba yendo con un rumbo muy bueno.

A ver, lleva desde la presentación de resultados hablando del plan Futurama, diseñado para seguir la buena racha y que todo esto no sea solo un ciclo, y que iba a ser presentado próximamente. Tocará ver si el nuevo CEO seguirá dicho plan o no (espero que sí).

Aún así, me parece un shock total, no me la veía venir (ni nadie creo yo). Tengo que decir que si bien me sorprende que se vaya del sector automóvil, no me sorprende que lo quieran en Kering. Gucci y el resto de marcas van (seamos honestos) como el culo, y De Meo ha demostrado ser bueno en (re)lanzar marcas (Cupra, Alpine…). Eso sí, han tenido que pagarle un buen billete.Pues me imagino que habrá sido una fortuna. Seguro que stellantis ya intentaría cazarlo y no le parecería suficiente.

Interesante artículo en QR sobre las posibles causas

Y curiosamente esta semana pasada hablaba de una legislación para los Kei Cars

Cansado de normas, hiperregulaciones, hundimiento del coche europeo gracias al radicalismo de Bruselas… ha dicho: BYE BYE que me voy a un sector más tranquilo a vender lujo que soy experto en marketing.

Recuerdo que últimamente hablaba del encarecimiento de los coches por las normas y regulaciones de Europa, que sus empleados antes podrían comprar coche nuevo y ahora ni un DACIA, la lucha en ACEA por volver al pragmatismo y el choque con los radicales de Bruselas…

Seguro que va a vivir más tranquilo con Gucci, Botegga, Balenciaga, Puma, YSL….

O realmente sabe que la industria del motor Europea está abocada al fracaso debido a las normas y normas y normas y normas…. y ha salido corriendo como lo hizo Griffits de Seat-Cupra.

Realmente sorprendente esta noticia. Se le veía bien en Renault. Veremos quien llega, qué es lo que puede hacer con la marca después de «Futurama», expansión de la marca, etc…

Según he leído, el grupo ha confirmado que seguirán el plan Futurama. También dice que en cabeza de lista para suceder a De Meo está Denis Le Vot, actual director de Dacia (no me parece mal candidato, está en la línea de De Meo y lo ha hecho bien en Dacia).

Nissan está pidiendo aplazar los pagos a proveedores según informan

a pique el portaviones?

Si no tenia problemas económicos gordos Nissan, se añade que parece que podría tener que cambiar casi medio millón de motores de su propia marca y de Infiniti…

Afectan a los 1.5 y 2.0 turbo VCT, los de compresión variable. Piden que se lleve a los concesionarios para evaluarlos, por si no es necesario cambiar los motores

Los modelos afectados son:

- 2021-2024 Nissan Rogue

- 2019-2020 Nissan Altima

- 2019-2022 Infiniti QX50

- 2022 Infiniti QX55

https://www.autoblog.com/news/nhtsa-recalls-nissan-rogue-altima-infiniti-qx50-qx55-engine

Tiny Defect May Land Half A Million Nissan And Infiniti Owners A Brand New Engine

- Regístrate para participar en el debate, puedes iniciar sesión desde el menú superior derecho o registrándote desde el botón "Regístrate" en el final de la página.